Include a depreciation estimate in your sales pitch. Before your client walks away from purchasing an investment property, make sure to crunch the numbers for them correctly.

That next bargain may actually be affordable for a property investor if depreciation is claimed.

Real Estate Agents usually encourage their clients to consider the potential rental return of the property, the property’s location in proximity to local services and facilities, local employment drivers and historical growth of properties within the area. However, they don’t always work out the tax deductible costs and explain the deductions involved in owning the property to the investor.

Costs such as property management fees, rates, interest, repairs, maintenance and property depreciation add to an investor’s net cash return and every deductible dollar comes back to the owner at their marginal tax rate.

The following example shows how a depreciation estimate helped one Real Estate Agent to make a potential investor aware of the additional cash flow of $4,992 they would receive in the first year of ownership alone, simply by claiming depreciation.

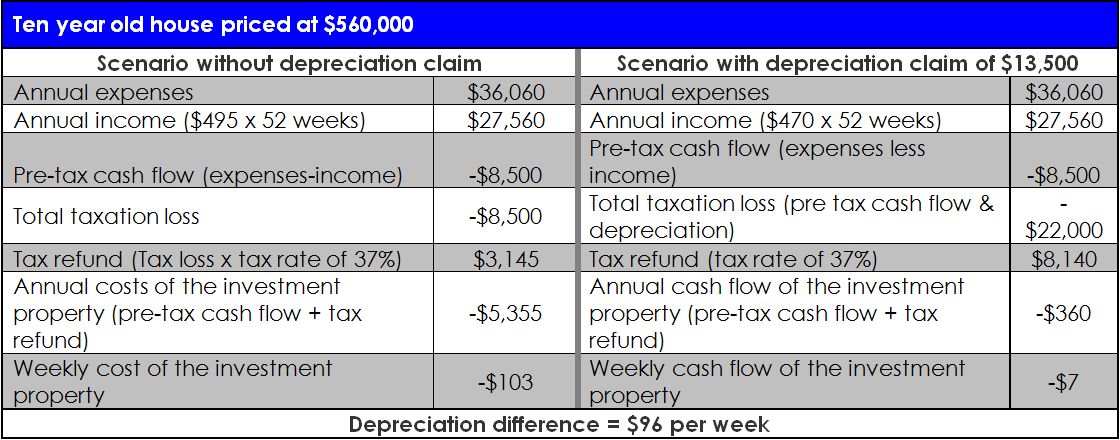

The property investor was considering purchasing a ten year old house priced at $560,000. During the investor’s inspection of the property, the Agent provided a rental appraisal which outlined an expected rental income of $530 per week, or $27,560 per year.

The Agent was also able to provide the investor with an estimate of the costs involved in owning the property. Expenses including interest rates, property management fees, rates, repairs and maintenance costs came to a total of $36,060 per annum.

The Agent contacted BMT Tax Depreciation for a free assessment of the likely depreciation deductions the investor could expect from the property and found that they would be able to claim approximately $13,500 in depreciation in the first full financial year.

The following table provides a summary of these costs and the investor’s annual position, depending on whether or not depreciation is claimed.

The depreciation estimates in this case study have been calculated using the diminishing value method of depreciation.

Without claiming depreciation, the property investor would experience a loss of $103 per week during the first year of owning the property. By claiming depreciation, the weekly cost is reduced to $7, saving them $96 per week or $4,992 in the first year of ownership.

By providing an estimate of the likely depreciation deductions to their investor client, the Real Estate Agent was able to help them to gain a better perspective of the affordability of the property and their future cash flow position.

To get a free depreciation estimate for your clients’ simply contact one of BMT Tax Depreciation’s helpful staff on 1300 728 726, or use the BMT Tax Depreciation Calculator. The calculator is available online or as an app for iPhone or Android phone.

Article Provided by BMT Tax Depreciation.

Bradley Beer (B. Con. Mgt, AAIQS, MRICS) is the Managing Director of BMT Tax Depreciation. Please contact 1300 728 726 or visit www.bmtqs.com.au for an Australia-wide service.

Since the 1986-1987 financial year Australia has operated a system of self-assessment of income tax, under which taxpayers’ returns are accepted at face value in the first instance.

The Australian Tax Office (ATO) may subsequently verify the accuracy of the information in the return within a prescribed period of time after that initial assessment. As a consequence, a significant proportion of Australians now submit self-assessed information when they lodge their tax returns each year. This includes property investors making self-assessed depreciation claims.

Although self-assessment makes it easier for individuals to lodge their tax returns, investors often lack the knowledge of complex tax legislation surrounding depreciation deductions. For this reason, a large percentage of investors miss out on thousands of unclaimed depreciation deductions each financial year. The risk of incorrect claims being made is also significantly higher, which can increase the risk of an audit being performed by the ATO.

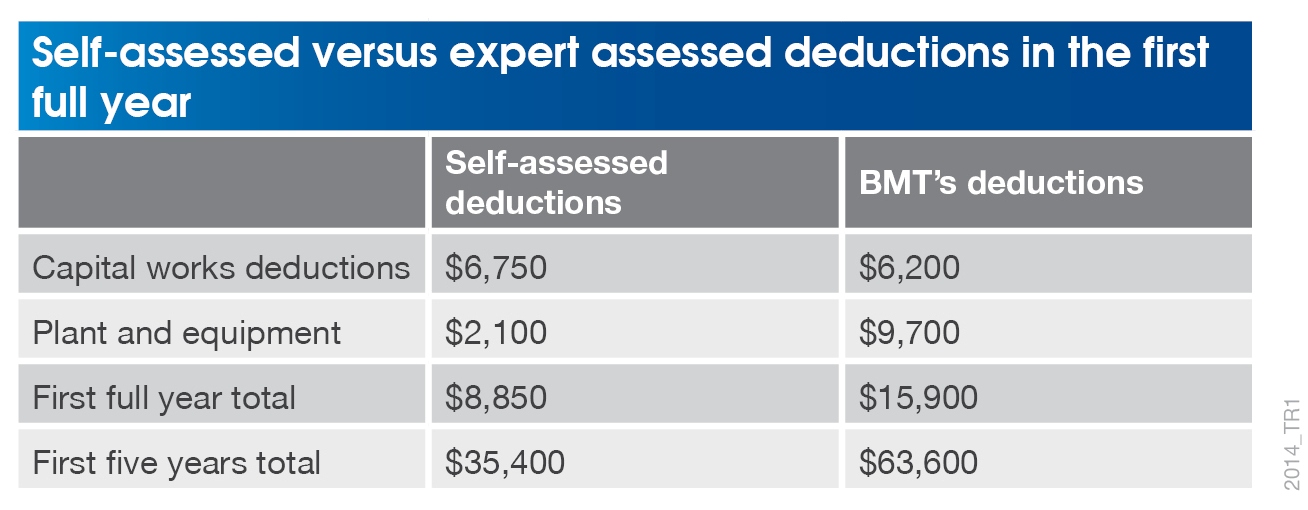

Working with Accountants and Property Professionals, specialist Quantity Surveyors such as BMT Tax Depreciation aim to educate property investors to make sure they lodge the correct property depreciation claims at tax time. A recent comparison of self-assessed deductions compared to the deductions identified by a depreciation specialist for an investment property found the difference in claims made to be considerable.

Depreciation example

A client purchased a three bedroom house in an outer Sydney suburb for $610,000. The property was constructed in 2004.

Deductions are based on a full financial year of ownership. Depreciation deductions were calculated using the diminishing value method of depreciation.

In the first full year of ownership BMT Tax Depreciation was able to identify an extra $7,050 in depreciation deductions and an extra $28,200 in deductions in the first five years when compared with the owner’s self-assessed deductions.

The deductions found for the capital works (or the structural component of the property) were similar, however deductions for plant and equipment items (or removable and mechanical assets) were grossly underestimated or completely missed when the investor self-assessed.

When a Quantity Surveyor prepares a tax depreciation schedule they will perform a site inspection of the property to identify plant and equipment assets which may otherwise be considered capital works. This will increase the rate at which items within the property can be depreciated, making the most of available deductions.

No item is too small to consider including in a depreciation schedule. Low-cost assets and low-value assets all add up and help to maximise depreciation benefits. If an asset has a sufficiently low-value, legislation allows it to be written off much faster and sometimes the full depreciable value of these assets can be claimed immediately. A tax depreciation schedule will also substantiate any claim should the ATO perform an audit.

Property professionals can help by educating their investor clients and encouraging them to engage a specialist Quantity Surveyor for their depreciation needs. By doing so, they will play a role in helping their clients to potentially increase their cash returns.

Article Provided by BMT Tax Depreciation.

Bradley Beer (B. Con. Mgt, AAIQS, MRICS) is the Managing Director of BMT Tax Depreciation. Please contact 1300 728 726 or visit www.bmtqs.com.au for an Australia-wide service.

Property investors can save even more. Smart investors are always looking for ways to boost the cash flow received from an investment property.

That’s why BMT Tax Depreciation provides additional information to assist Property Managers in educating their clients about property depreciation.

The Australian Taxation Office (ATO) allows the owner of any income producing property to claim depreciation deductions for the wear and tear of the building structure and the plant and equipment assets contained within the property.

On average, property investors can claim between $5,000 and $10,000 in deductions in their first full financial year. This is no small amount, especially for an investor who is juggling the costs of mortgage repayments, rates, repairs and property management fee’s as well as other expenses related to holding the property.

For a limited time, BMT Tax Depreciation is offering your investor clients even more to help them save. The BMT Tax Depreciation Education Letter offers investor clients a reduced fee of $697 including GST if they order a tax depreciation schedule prior to June 30. In addition to this discount, your clients will receive a free six month subscription to a magazine of their choice.

Property Managers can click here to order copies of the BMT Tax Depreciation Education Letter for their clients.

Article Provided by BMT Tax Depreciation.

Bradley Beer (B. Con. Mgt, AAIQS, MRICS) is the Managing Director of BMT Tax Depreciation. Please contact 1300 728 726 or visit www.bmtqs.com.au for an Australia-wide service.

Never miss the stories that impact the industry.