‘Clear and Simple’ Risk Advice (Valuable, Efficient & Compliant)

Promoted by Astute Wheel

What if clients provided information before meetings; you could use a risk needs analysis tool live, auto-generate file notes, enter new policy details & generate a SOA in minutes?

- A

- A

- A

ASIC RG 244

ASIC’s Regulation Guideline RG 244 Table 2 provides the following guidelines for financial advisers to provide scaled advice.

As an advice provider, you will:

- Use your judgement and training to decide whether, by limiting the scope of the advice, you can provide scaled advice that meets your legal obligations. (See RG 244.65– RG 244.68 and RG 175.261– RG 175.280)

- Adjust the level of your inquiries to reflect the nature of the advice being provided. (See RG 244.69– RG 244.73 and RG 175.281– RG 175.297)

- Implement systems that will help you decide whether scaled advice can be provided to a client in a way that meets your legal obligations. (See RG 244.74– RG 244.80 and RG 175.236– RG 175.241)

- Communicate clearly to the client the type of advice service you are offering.

FASEA Code of Ethics

FASEA Code of Ethics Standard 5 requires that “all advice and financial product recommendations that you give to a client must be in the best interests of the client and appropriate to the client’s individual circumstances. You must be satisfied that the client understands your advice, and the benefits, costs and risks of the financial products that you recommend, and you must have reasonable grounds to be satisfied”.

The FPA’s FASEA Explanatory Statement emphasises “the importance of the client properly understanding the advice and recommendations you give, and their implications. It requires you to be satisfied that the client understands:

- the advice and recommendations you give; and

- the benefits of the recommended products; and

- the costs involved in acquiring, holding and disposing of the recommended products; and

- the risks involved in acquiring, holding and disposing of the products; and

- how you recommend they be managed.

This means that your risk advice must be ‘clear and simple’.”

So, the Statement of Advice (SOA) must be clear and simple too. Does anyone actually produce a clear and simple SOA? Many advisers think SOA’s are far from it.

How to provide ‘clear and simple’ risk advice quickly and compliantly:

1. Pre-Meeting (Client)

- New clients complete a mini fact find before the meeting

- Review clients update their details in an electronic reverse fact find, prior to meetings

- This client information is time and date stamped and populates or updates the ‘know your client’ fact find database

- Your admin team can add additional policy details into the fact find so the information is ready to feed into the SOA

- The fact find database pre-populates your risk needs analysis calculator, so you are ready for the client meeting.

- Time: 10 minutes to review the information provided by the client.

2. Client & Adviser Meeting (face-to-face or online)

- You can use your risk needs analysis calculator live with the client

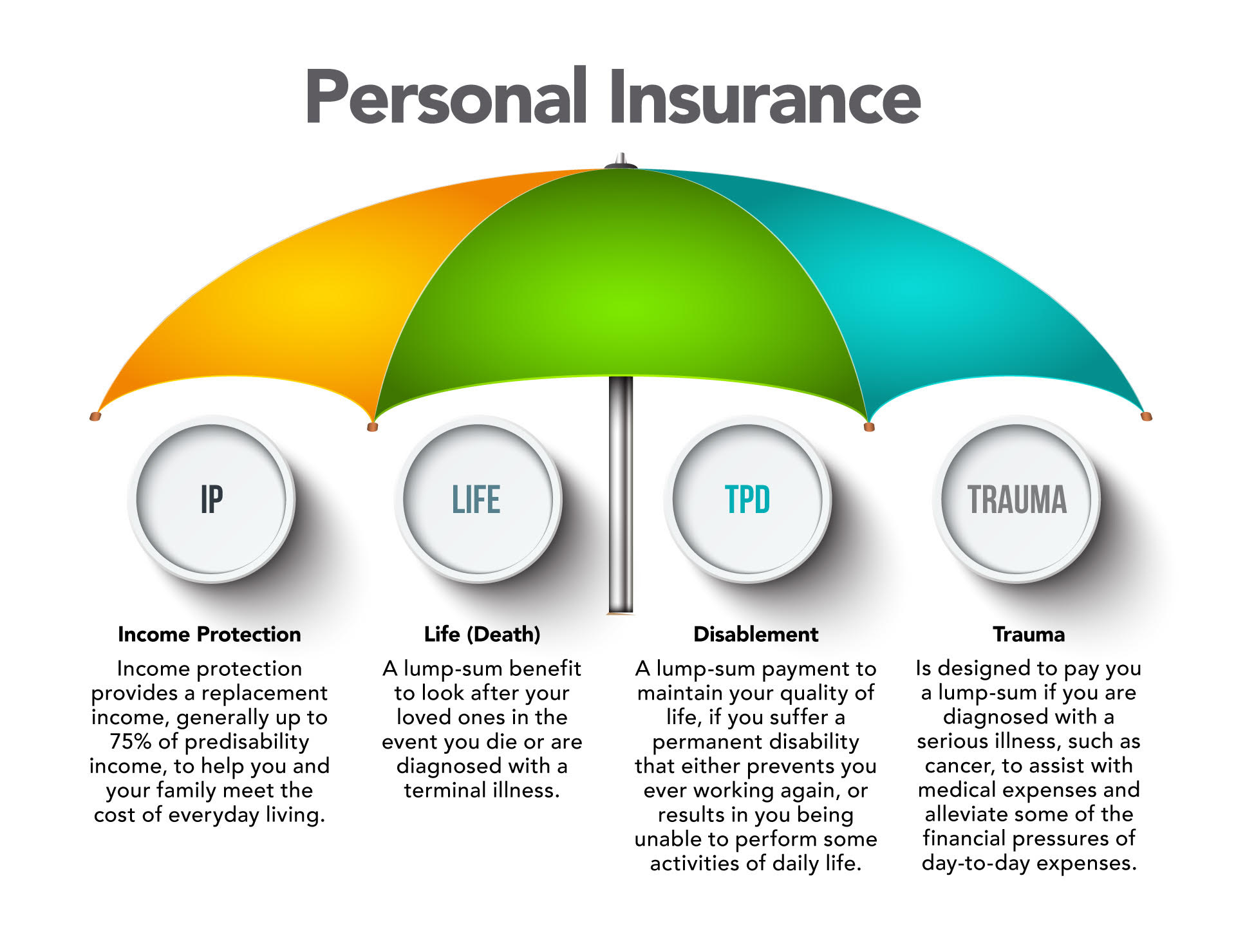

- You ask them a structured set of questions for each of the four types of personal insurance (IP, Life, TPD, Trauma)

- The client decides if they want to cover certain things by answering ‘yes’ or ‘no’ to your “do you want to cover this?” questions

- And they decide on the amounts to be covered or ask you for guidance

- You have a Summary Tab where they decide (after your explanations) if they want ‘stepped’ or ‘level’, ‘owned personally’ or ‘in Super’ etc. and you can record their decisions.

- Save the scenario and auto-generated file notes for compliance.

- Time: 30 - 40 minutes to conduct the Needs Analysis meeting.

3. Insurance Policy Research (Paraplanner)

- You (or your paraplanner) can use tools like Risk Researcher or OmniLife to find the best value for money insurance policies for the client

- These could be replacement products, additional products, top-ups or reduced amounts

- Your paraplanner adds any new policy details, features and benefits, premiums, commissions and splits into the Policy Tab of the tool

- They can recommend canceling, retaining or modifying existing policies and add reasons and impact

- Save the information so it is ready to feed into the SOA

- Time: 20 - 30 minutes to research insurance policies and add information.

4. Generate Clear Simple and Compliant Risk Advice Document (Adviser)

- Click: ‘Generate Strategy Paper’ or ‘Generate SOA’

- Review a 12-page SOA document that contains:

- a free text introduction paragraph

- auto-generated client information, charts, calculations, policy details

- reasons for, and implications of, new, modified or cancelled policies

- costs – premiums, advice fees, commissions

- Time: 1 minute to produce the SOA and 10 minutes to review it.

Conclusion

Take a client through this process and the client will understand:

- the insurance advice and recommendations you give; and

- the benefits of the recommended insurance products; and

- the costs involved in acquiring, holding and disposing of the recommended insurance products; and

- the risks involved in acquiring, holding and disposing of the insurance products, and

- how you recommend the insurance be managed.

And your insurance advice will be both ‘clear and simple’.

If you would like to see a demonstration of how the above process works, then register for the Astute Financial Planner webinar by clicking on the link below:

www.astutewheel.com.au/book-webinar

Michael Topper is a Director of AstuteWheel

Subscribe to

Never miss the stories that impact the industry.