More gain, less pain at tax time

Promoted by

Investment bonds are rapidly growing in popularity as super loses some of its appeal as a tax-saving tool – and with tax paid by the provider, no Medicare Levy, no limit on contributions and access to your money at any stage, it’s easy to understand why.

- A

- A

- A

Also known as insurance bonds, investment bonds can be classified as ‘tax-paid’ investments since the provider pays the tax on investment earnings. The rate of tax paid is generally up to the current company tax rate of 30%. There is no Medicare Levy, no limit on contributions and you can access your money at any stage. For clients particularly on a high income, this can be a tax-effective1 way to invest.

The 125% rule and withdrawal periods

Investment bonds are also very simple at tax time. Clients don’t include investment earnings in their tax return unless a withdrawal is made in the first 10 years. After 10 years, if the client has adhered to the 125% rule (where each year’s contributions did not exceed 125% of the previous year’s), any withdrawals made will not attract personal income tax or capital gains tax. Capital gains tax is also not applicable when switching between investment options.

For clients that do withdraw before the 10-year period is satisfied, all or part of the profit portion or investment earnings will be included in their assessable income. The amount of profit included in the client’s assessable income depends on when they make a withdrawal. For example, if a client withdraws:

- within eight years, all of the profit is included as assessable income;

- during the ninth year, two-thirds of the profit is included as assessable income;

- during the 10th year, one-third of the profit is included as assessable income; and

- after the 10th year, no personal tax is payable.

A 30% tax offset is available and can be used against any tax payable on the withdrawal amount. Any residual tax offset may also be used against tax(es) on other income.

Estate planning benefits

Taxation upon death is a large consideration for advisers, clients and beneficiaries, particularly when clients have non-dependent children as beneficiaries. In the superannuation environment, death benefits that are paid to non-dependants risk tax of up to 32%. Insurance bonds offer an alternative in these situations as they allow proceeds to be paid to any beneficiary (including non-dependants) tax free.

Leaving the tax benefits aside, these bonds can also be structured in a number of ways to solve estate-planning problems. Clients can nominate more than one beneficiary and can stipulate the percentage or amount that each will receive. When a beneficiary is nominated, the proceeds will not be subject to challenges to the client’s estate (except in NSW), as they will not form part of the estate assets.

Further, for clients with children with a marriage at risk, bonds can provide a level of asset protection. Upon death of the client (i.e. the parent), bond proceeds can be paid to their estate and included in the creation of a discretionary trust in their will for the benefit of children and grandchildren.

In other situations where the client only wants to provide for grandchildren, the bond can be set up as a Child Advancement Policy. Ownership would automatically transfer to the grandchild at a stipulated age, generally without capital gains tax consequences.

Safety and security are important considerations for many clients, especially when the market is volatile. CommInsure’s Investment Growth Bond (IGB) offers a unique Death Benefit Guarantee, which is designed to provide certainty around the minimum amount paid on death. The IGB also offers nine Lonsec rated2 investment options, four (Cash, Global Fixed Interest, Conservative, Diversified) of which offer investment option guarantees The investment option guarantees are designed to provide certainty around the minimum value of a client’s holding in the investment option. That is one of the reasons that the CommInsure IGB was the winner of the AFA/Plan For Life Investment Bond of the year Award3 for the last 8 years in a row.

The potential taxation concessions and estate planning benefits alone mean that investment bonds can be a very important tool for advisers and their clients. Whilst individual needs are to be considered, these bonds continue to provide an attractive investment option for high-net-worth clients.

Advantages for high income earners

- Tax paid at up to the company rate of 30% by the life company. To compare, earnings from a managed fund could be taxed at up to 49% (inclusive of Medicare Levy and applicable charges).

- If part of a withdrawal is required to be included in assessable income, a tax offset of 30% is available to compensate for the tax paid. This may be used to offset tax on other income.

- Unlike direct investments, personal capital gains tax is not relevant to insurance bonds.

- No need to declare earnings in personal tax returns while the money is invested in the investment bond.

- Withdrawals from the bond are free from personal income tax after 10 years.

- The start date of the 10 year tax period remains unchanged if the contributions in each policy year do not exceed 125% of the previous year’s contributions.

- Can be used as an alternative to super to build wealth for retirement. Contribution limits within the super environment minimise the amount of money your clients can concessionally invest, and the preservation rules may restrict access to funds.

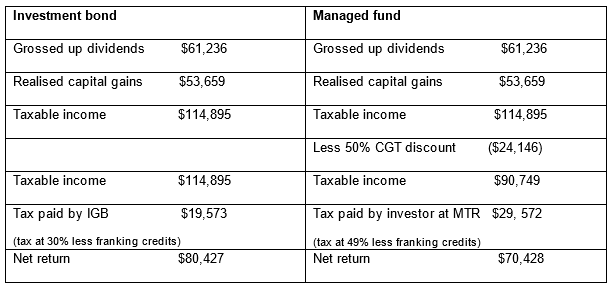

Tax savings at a glance

The following table shows the potential taxation consequences of investing in an investment bond versus a managed fund. The investment shown below is an Australian share portfolio, with dividends and realised capital gains of $100,000.

Assumptions: Australian share portfolio returns 46.3% income and 53.7% realised capital gains. Franking ratio 75%. Franking credits $14,895. 90% of investment held for over 12 months. Investor marginal tax rate 49% (including Medicare Levy and temporary budget repair levy). Investment Growth Bond tax rate 30%.

By George Lytas, Head of Annuities, CommInsure

CommInsure Investment Growth Bond

To find out more or to speak to one of our Business Development Managers, please visit comminsureadviser.com.au/igb

1Refer to the CommInsure Investment Growth Bond PDS for more information.

2Lonsec rating, February 2016: NC* Cash – Recommended; NC International Shares – Investment Grade; NC Australian Shares – Investment Grade; NC Global Fixed Interest – Recommended; NC Global Property – Investment Grade; NC Conservative, NC Diversified, NC Balanced, NC Growth – Investment Grade.

3The CommInsure IGB has won the Association of Financial Advisers (AFA)/Plan for Life (PFL) Investment Bond of the Year Award for the last 8 years running.

*Nil Commission

The CommInsure Investment Growth Bond is issued by the Colonial Mutual Life Assurance Society Limited ABN 12 004 021 809 AFSL 235035 (CMLA, trading as CommInsure). Taxation considerations are general and based on present taxation laws and may be subject to change. You should seek independent, professional tax advice before making any decision based on this information. CommInsure is also not a registered tax (financial) adviser under the Tax Agent Services Act 2009 and you should seek tax advice from a registered tax agent or a registered tax (financial) adviser if you intend to rely on this information to satisfy the liabilities or obligations or claim entitlements that arise, or could arise, under a taxation law.

Subscribe to

Never miss the stories that impact the industry.