With the evolution of professionalism and the new education standards, have we lost the art of good storytelling in advice?

It is a commonly held belief that the changing guard of advisers lacks the life experience and mentorship that the more experienced advisers once provided. For newer advisers, there is the ever-present challenge of learning how to connect and engage effectively with clients. How to impart your values, and motivate your clients to take action, to take control over their financial wellbeing. If clients don't feel emotionally connected to understanding and achieving their goals and objectives, they are less likely to value and commit to the advice process. And as we all know, if they do not value your advice, they are unlikely to be willing to pay for it!

Opinion is divided as to whether storytelling is an art or a science. I believe that storytelling is an art, and like all artistic endeavours, it takes time and practice. For some, storytelling comes naturally, and for some, it does not. Traditionally, life insurance advisers were great storytellers. They understood the importance of connecting with the client and sharing experiences that make the advice more tangible. Storytelling would help a client to understand and strongly believe in the importance of being protected and subsequently would proceed with their insurance recommendations.

In advice, effective storytelling can bolster the entire advice process, from engaging with prospects to the ongoing relationship with the client.

Why is storytelling so important for advisers?

Storytelling is a great way to connect with your clients and help them understand what often are, complicated concepts. It can help your clients to connect the dots between what the strategy looks like to achieve their goals and objectives, and why it is so important to them.

Great stories can motivate clients to take action, and they also are wonderful at helping you to put yourself in somebody else's shoes and see things from a different perspective.

Telling a story can be as simple as reflecting on your experience, or that of someone close to you. The story should resonate with what the client in front of you is experiencing. Put them in someone else's shoes so that they can better understand their personal situation, and connect the dots towards your advice.

Storytelling comes in many different forms

Employ it in written form (articles, blogs, social media, and even your advice documents!) Storytelling in spoken form is so powerful in introductory meetings as well as review meetings, keynotes, webinars, and videos, as well as via audio platforms such as podcasts.

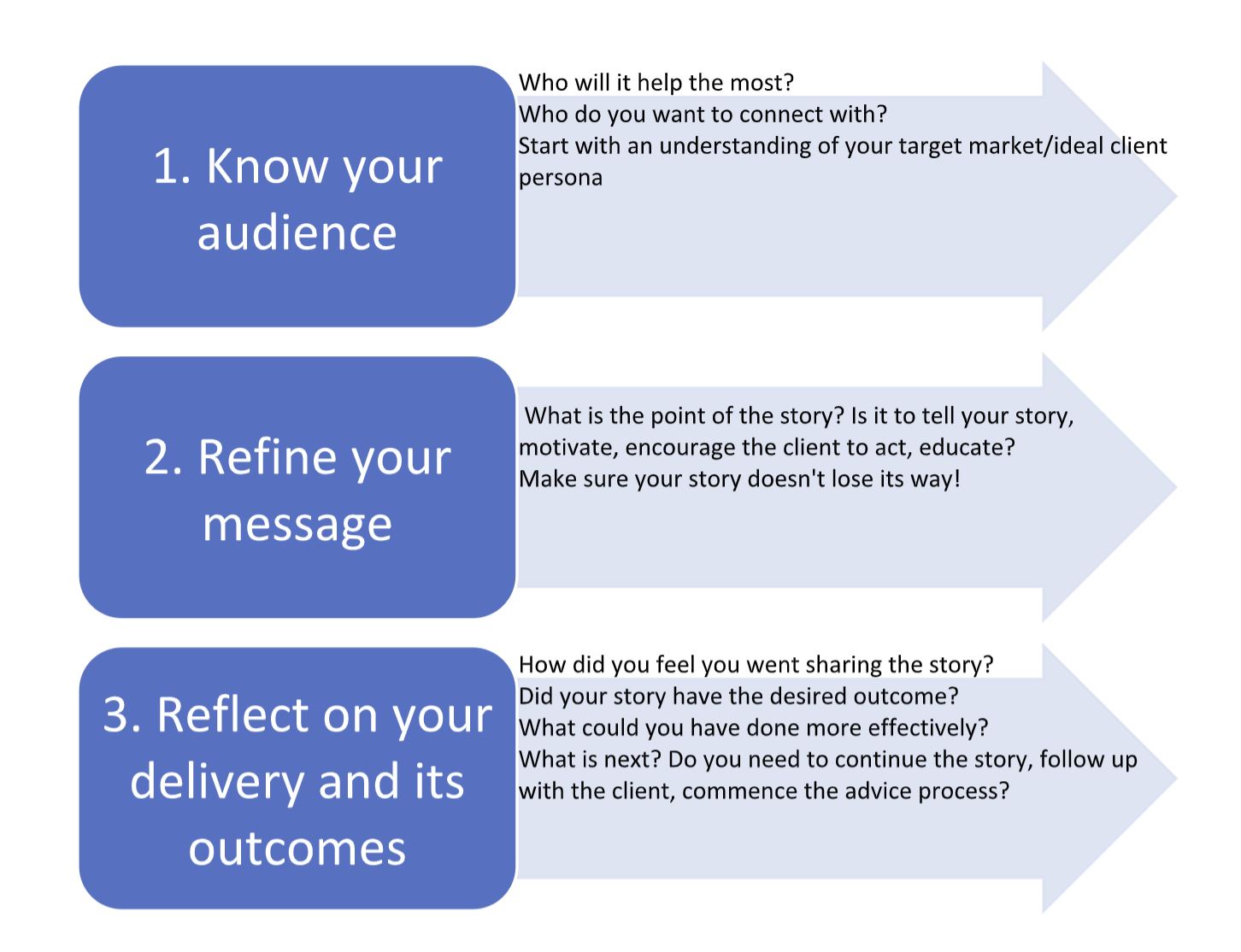

The storytelling process

5 tips for storytelling mastery

Finally, your language is critical. Steer clear of financial services jargon, keep it simple, and always remember that the story is never all about you. It is about how the client connects with the story you are telling and understands what steps next to take. Everybody has a story to tell. Tell yours!

Lisa Gregory, marketing development manager, Lifespan Financial Planning

Neil is the Deputy Editor of the wealth titles, including ifa and InvestorDaily.

Neil is also the host of the ifa show podcast.

Never miss the stories that impact the industry.