The Australian Securities and Investments Commission (ASIC) has released new statistics.

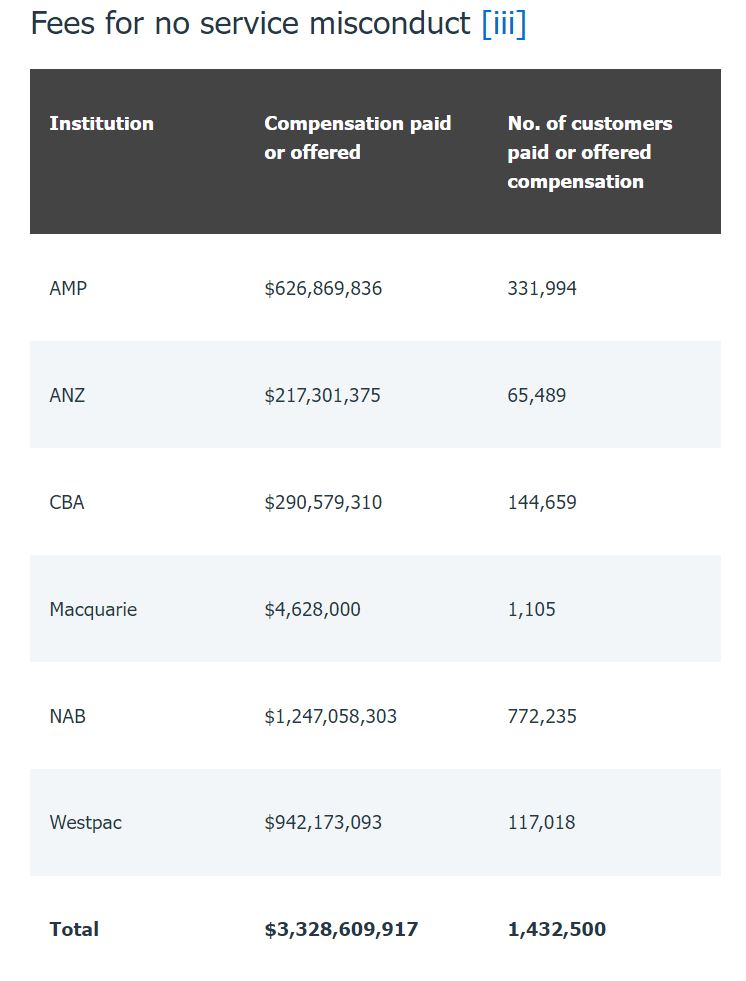

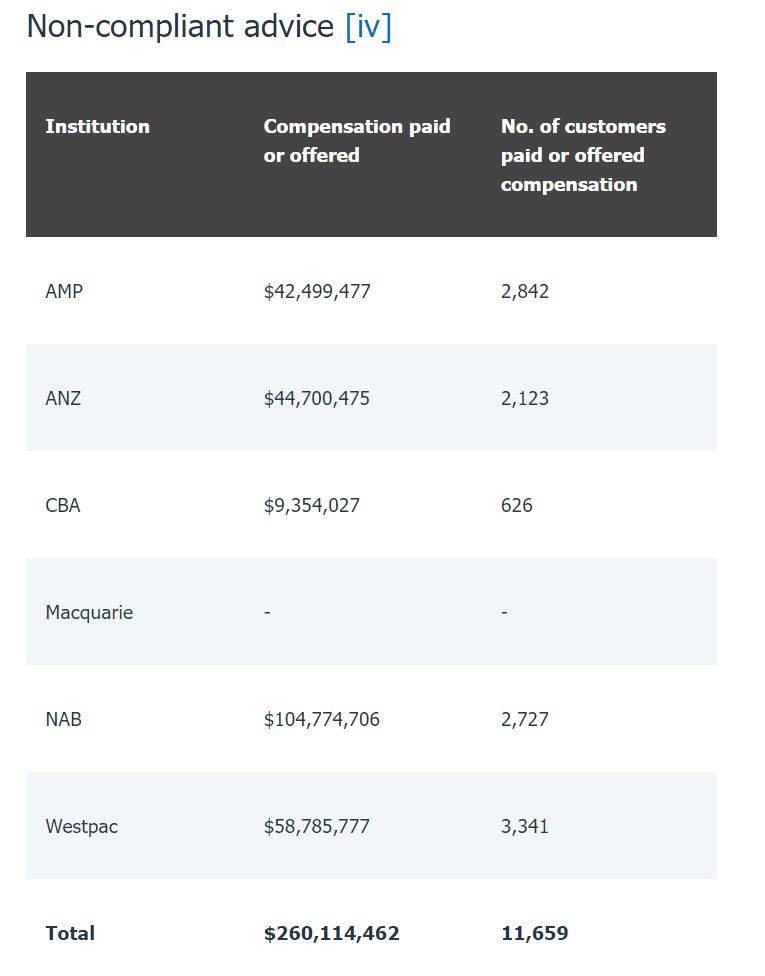

Six of Australia’s largest banking and financial institutions have paid or offered a total of $3.6 billion in compensation as at 30 June 2022 to customers who “suffered loss or detriment because of fees for no service misconduct or non-compliant advice”, ASIC has confirmed.

The corporate watchdog confirmed the news following a review undertaken by AMP, ANZ, CBA, Macquarie, NAB and Westpac, which also includes $438 million paid or offered between 1 January and 30 June 2022.

NAB paid or offered the most compensation for fees for no-service misconduct of the six institutions, with ASIC confirming the bank’s total to be $1,247,058,303, followed by Westpac at $942,173,093.

NAB also paid or offered the most compensation for non-compliant advice at $104,774,706.

ASIC commenced the reviews to look at “the extent of failure by the institutions to deliver ongoing advice services to financial advice customers who were paying fees to receive those services” and how effectively the institutions supervised their financial advisers to identify and deal with non-compliant advice.

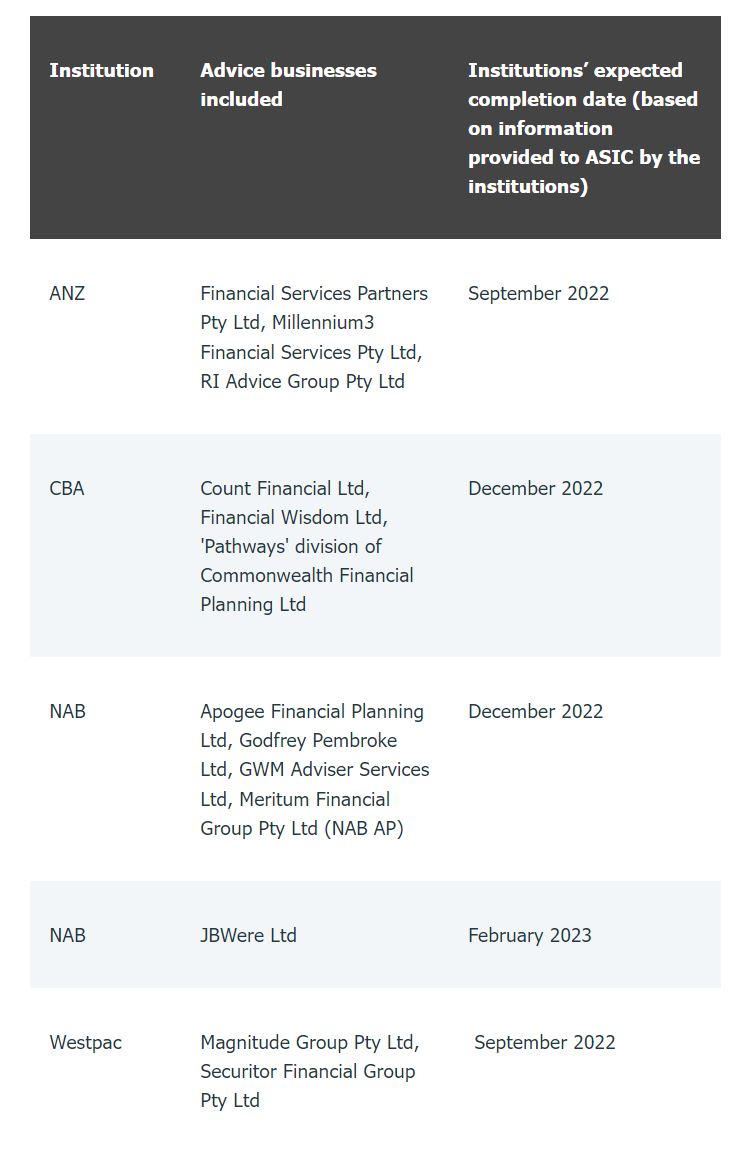

CBA, ANZ and Westpac have all notified ASIC that customers who have been identified as receiving inappropriate advice have been remediated.

In relation to the fees for no service, some of the institutions have not yet “substantially completed” programs, including Financial Services Partners (ANZ), expected to be completed next month, and Count Financial (CBA), set for completion in December.

The review and remediation program by the institutions came after two major reviews conducted by ASIC, first in 2016 when it described “systemic failures in the advice divisions of AMP, ANZ, CBA and NAB”.

In 2017, ASIC undertook another review into how large institutions oversee their advisers.

“Since the publication of this report, ASIC has been monitoring the ongoing implementation of the institutions’ customer review and remediation programs,” the regulator said.

Neil is the Deputy Editor of the wealth titles, including ifa and InvestorDaily.

Neil is also the host of the ifa show podcast.

Never miss the stories that impact the industry.