ASIC has released its latest enforcement and regulatory update.

About 50 financial services enforcement litigation matters between 1 January and June 30 2022 are still in progress, according to ASIC.

In the corporate regulator's latest enforcement and regulatory update, it has been confirmed that 26 criminal matters are still in progress, as are 24 civil matters.

Financial advice misconduct matters make up a large number of the criminal enforcement matters at 11, followed by superannuation misconduct at six, and investment management misconduct at five.

The figure is down from the 70-plus matters reported by ASIC in the previous update.

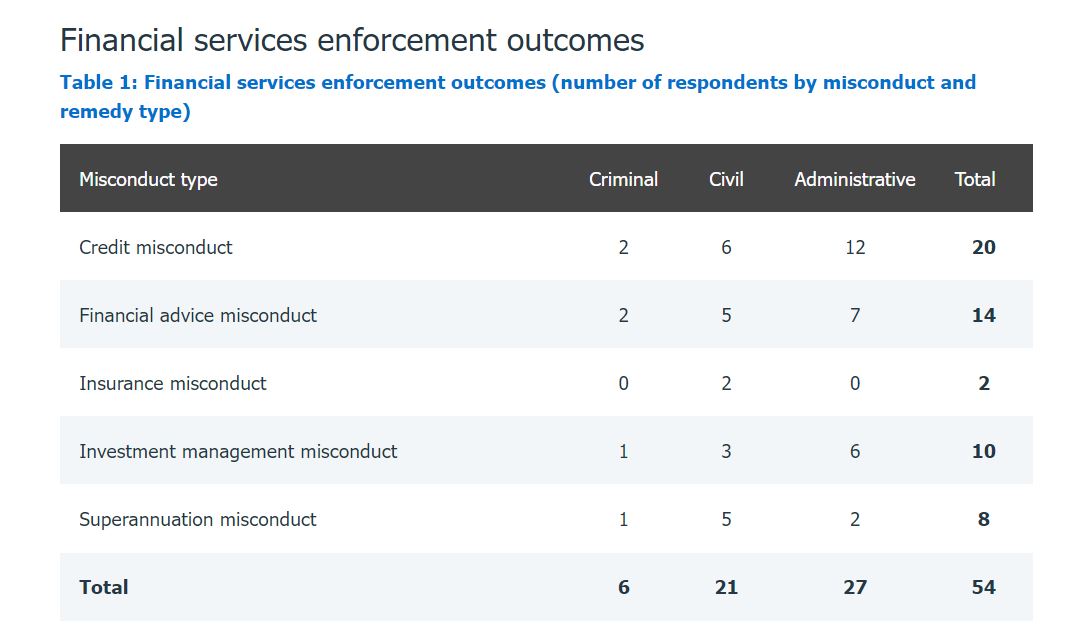

Meanwhile, ASIC has reported 54 financial services matters with outcomes, with 27 being administrative, 21 being civil and 6 being criminal.

Of the 27 administrative matters, 12 were made up of credit misconduct issues and seven were financial advice misconduct matters.

In total, between 1 January and 30 June 132 criminal charges were laid, with 25 individuals charged in criminal proceedings. $145.8 million was imposed in civil penalties by the courts, 31 individuals were removed or restricted from providing financial services or credit, and 26 individuals were disqualified or removed from directing companies.

Another 171 criminal charges were also laid in summary prosecutions for strict liability offences, while $26,640 was paid in infringement penalties.

Of the ongoing investigations, 60 have commenced and 148 are ongoing.

"During the quarter, we continued to focus on discharging our regulatory and enforcement responsibilities and launched litigation against misconduct," ASIC said in a statement.

"We took action in the Federal Court against entities where we allege that Australian consumers were misled or charged excessive fees."

Meanwhile ASIC also reported 121 small business enforcement outcomes between January and June; 88 being 33 criminal matters in relation to action against persons or companies and 33 administrative.

86 matters are still in progress.

Neil is the Deputy Editor of the wealth titles, including ifa and InvestorDaily.

Neil is also the host of the ifa show podcast.

Never miss the stories that impact the industry.