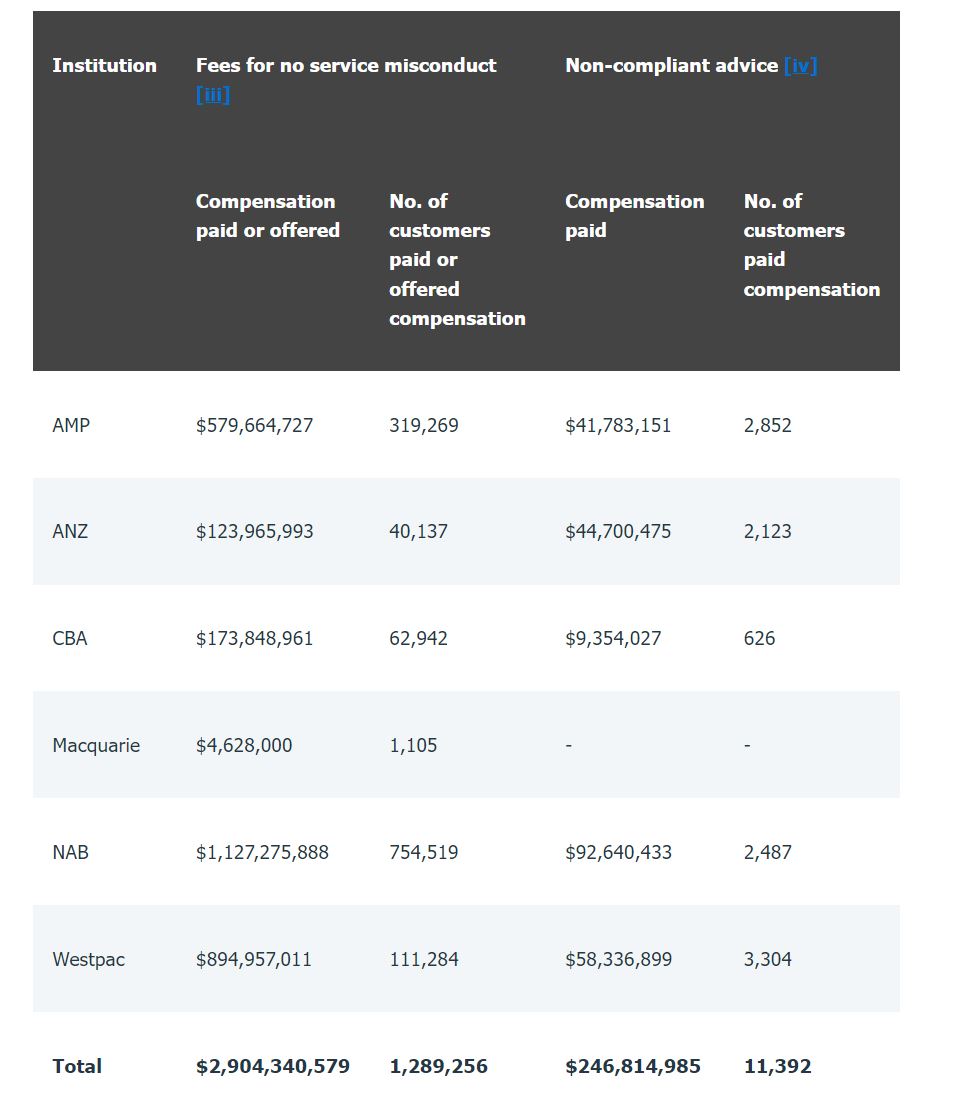

Six of Australia’s biggest banking and financial services institutions have paid or offered over $3 billion in compensation for financial advice-related misconduct, ASIC has revealed.

The corporate regulator has confirmed that $3.15 billion as at 31 December 2021 has been paid or offered to customers of AMP, ANZ, CBA, Macquarie, NAB and Westpac who suffered loss or detriment because of “fees for no service misconduct or non-compliant advice”.

Almost $1.3 billion of that figure was paid or offered between 1 July and 31 December 2021.

NAB paid or offered the most compensation out of any of the institutions with $1,127,275,888, ahead of Westpac with the second most amount at $894,957,011.

Meanwhile the highest number of customers who were paid compensation came from AMP with the total figure being 2,852.

The six institutions undertook the ASIC review that looked into the extent of failure to deliver ongoing advice services to customers who were paying feeds to receive those services and how effectively the institutions supervised their advisers to identify and deal with “non compliant-advice”.

See the full breakdown below.

Neil is the Deputy Editor of the wealth titles, including ifa and InvestorDaily.

Neil is also the host of the ifa show podcast.

Never miss the stories that impact the industry.