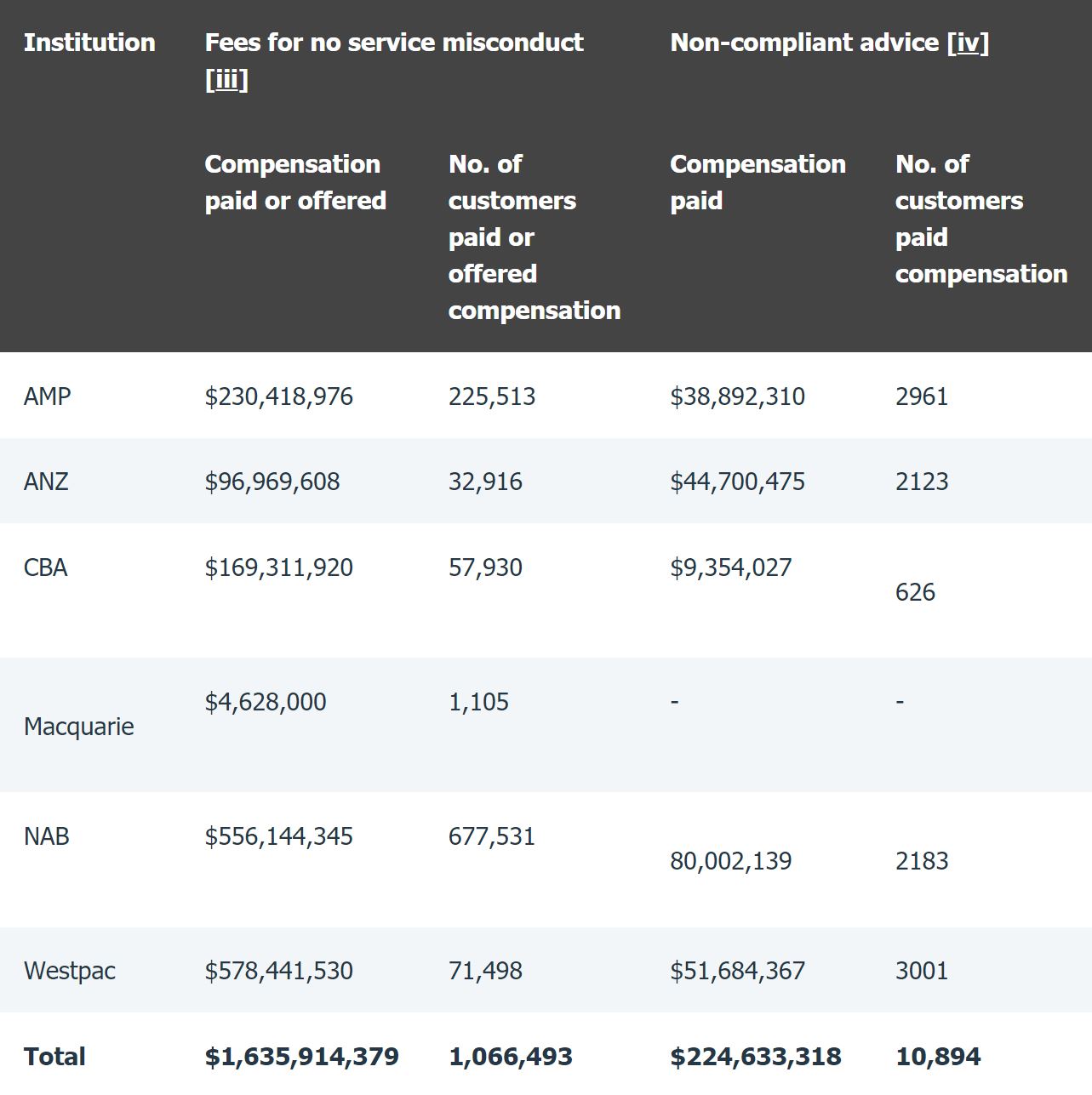

Almost $2 billion in compensation has been paid or offered by major Australian institutions in relation to financial advice-related misconduct.

On Thursday, ASIC reported as of 30 June 2021, AMP, ANZ, CBA, Macquarie, NAB and Westpac have paid a total of $1.86 billion in compensation, $620.9 million of which was paid between 1 January and 30 June.

The six institutions undertook the ASIC review that looked into the extent of failure to deliver ongoing advice services to customers who were paying fees for that service and how effectively the institutions supervised their advisers to identify and deal with “non-compliant advice”.

The largest figure paid or offered came from Westpac ($578,441,530) that was paid to 3,001 customers, while AMP paid or offered $230,418,976 to 2,961 customers.

Overall, 1,066,493 customers were paid or offered compensation.

Neil is the Deputy Editor of the wealth titles, including ifa and InvestorDaily.

Neil is also the host of the ifa show podcast.

Never miss the stories that impact the industry.