BREAKING ASIC has revealed that Australia’s six largest financial institutions have now paid out hundreds of millions to customers impacted by financial advice related misconduct.

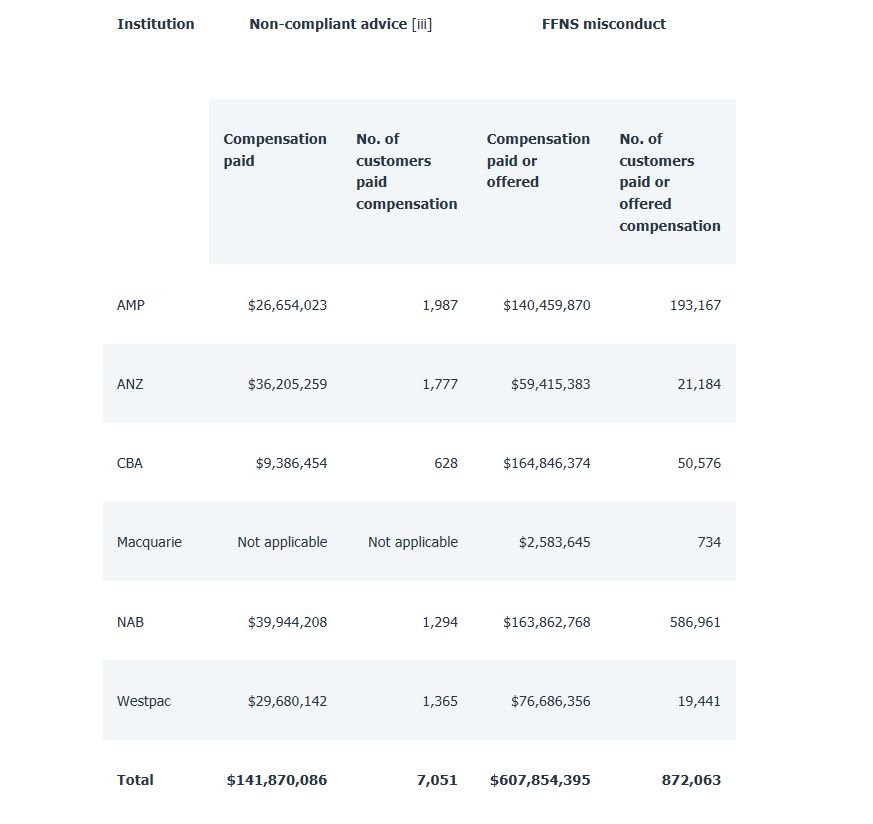

AMP, ANZ, CBA, Macquarie, NAB and Westpac have paid or offered a total of $749.7 million in compensation as at 31 December 2019 to customers who suffered loss or detriment because of non-compliant advice or fees-for-no-service misconduct.

NAB has paid or offered $163,862,768 compensation in total, while CBA has paid or offered $164,846,374. AMP came in third, with $140,459,870 paid or offered.

(source: ASIC)

The reports were released in 2017 and 2016, respectively.

The remediation programs began as a result of two major ASIC reviews in 2015 that examined how effectively institutions supervised their financial advisers and the extent of failure by the institutions to deliver ongoing advice services to customers who were paying fees for no service.

A financial services provider whose advisers recommended clients roll over their super into SMSFs and use those funds to ...

With another federal election looming, Labor must now ask: has it really cleaned up the “hot mess” in financial ...

The FAAA’s newly launched Federal Election Hub has painted an interesting picture, one where those scorned by advisers ...

Never miss the stories that impact the industry.

Get the latest news! Subscribe to the ifa bulletin