The Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry has released the list of organisations it will require to appear at the hearings relating to financial advice.

The second round of royal commission hearings will commence on Monday, 16 April and will focus on the conduct of financial advice providers, with institutions and associations well represented among the organisations compelled to appear before the inquiry.

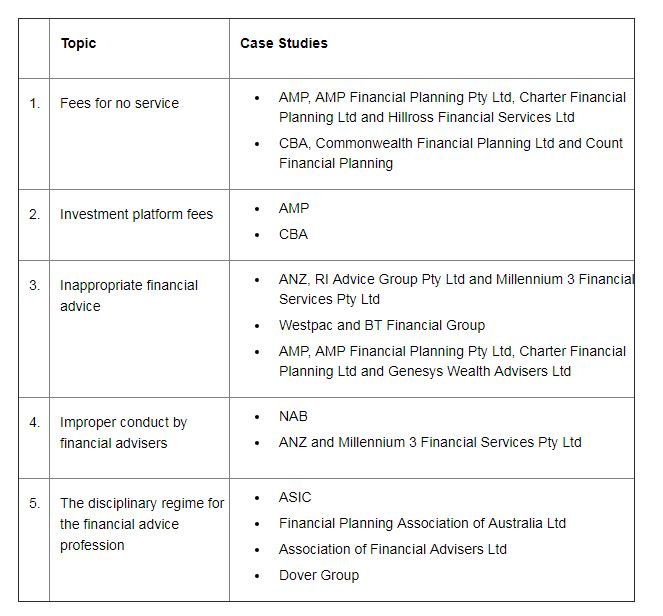

The first topic will be “fees for no service”, reflecting on the cases whereby ASIC has instructed institutions to pay reparations to customers who paid fees for advice that was never provided.

Representatives of AMP and CBA, and their various dealer group subsidiaries, will be required to give evidence on this topic.

Later on in the proceedings, ASIC, the AFA and FPA will provide evidence on the topic of disciplinary regimes governing financial advisers.

Dover Financial Advisers is the sole non-institutional licensee being called to appear before the royal commission.

The full list of specified appearances for the financial advice hearings can be seen below:

Never miss the stories that impact the industry.