The Australian Tax Office is under pressure over an online hypothetical accused of proliferating negative perceptions of the financial advice profession.

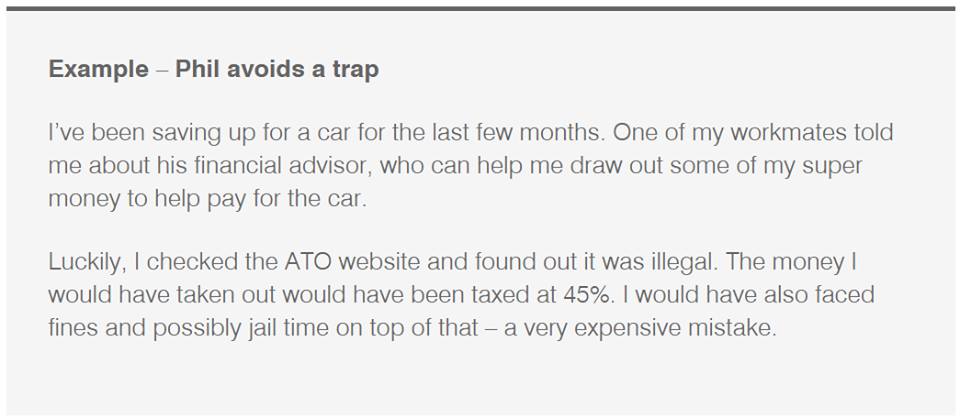

A number of financial advisers raised concerns about the following post on the ATO website, which features a hypothetical example of a financial adviser providing a consumer with “illegal” information:

Speaking to ifa, Henderson Maxwell principal and Sky News Business host Sam Henderson said the ATO should be held accountable for the damage this kind of implicit bias can have on the livelihood of Australian professionals.

“The anti-adviser mindset is pervasive across many channels at the moment, including within our own ranks and associations,” Mr Henderson said.

“Advisers are hard-working people with their clients best interests at heart. I've been on the receiving end of criticism to the highest level and frankly it's exhausting, so disappointing and not reflective of the great value we add to so many people's lives.

“This ATO comment is divisive, misleading and denigrating to an important industry on the rise.”

The ATO has subsequently amended the post, removing any reference to a financial adviser and replacing the image with the following:

ifa understands that the AFA, FPA and advisers associated with the XY Adviser community group separately voiced concerns to the tax authorities.

Never miss the stories that impact the industry.