Protecting portfolios through the storm

Contrary to the notion that fixed income should exhibit a negative correlation to equities, suggesting that when one goes up, the other goes down, in our view, it’s more accurate to view fixed income as a stabilising force within a portfolio. Instead of focusing solely on returns, investors should also consider the invaluable function of fixed income can have in reducing overall portfolio volatility and improving risk-adjusted returns.

Historically, equities have exhibited higher volatility, compared to bonds, reflecting the relatively stable income streams of bonds and their fixed coupon payments. While bonds can still experience price fluctuations, especially in response to changes in interest rates or credit risk, these movements are generally less pronounced compared to equities.

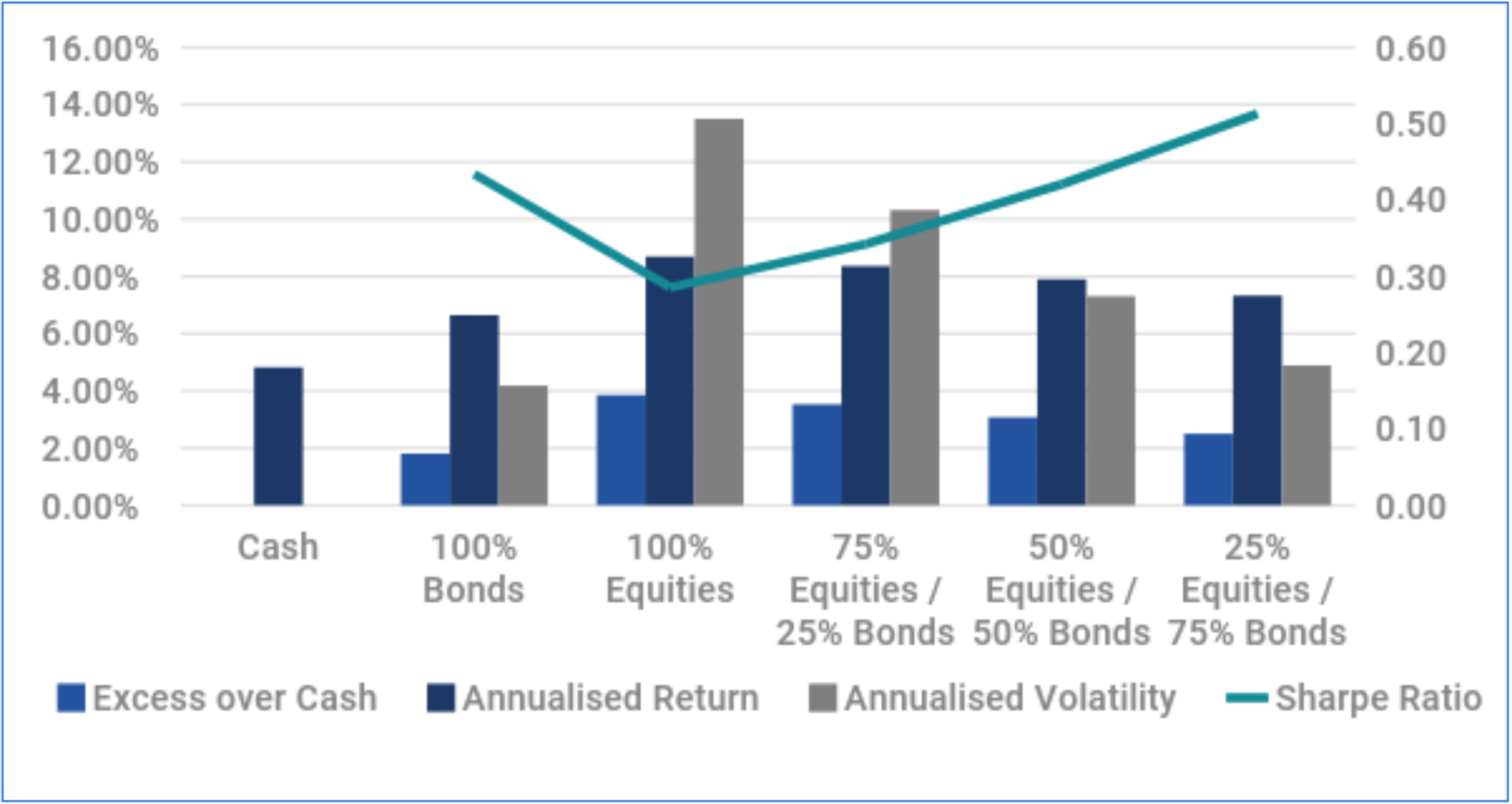

Even small bond allocations in a portfolio can help dampen portfolio volatility for a small reduction in overall return and improving risk adjusted returns (Sharpe ratio).

Chart 1: Historical risk adjusted return comparison of bonds and equities

Source: Bloomberg, Yarra Capital Management.

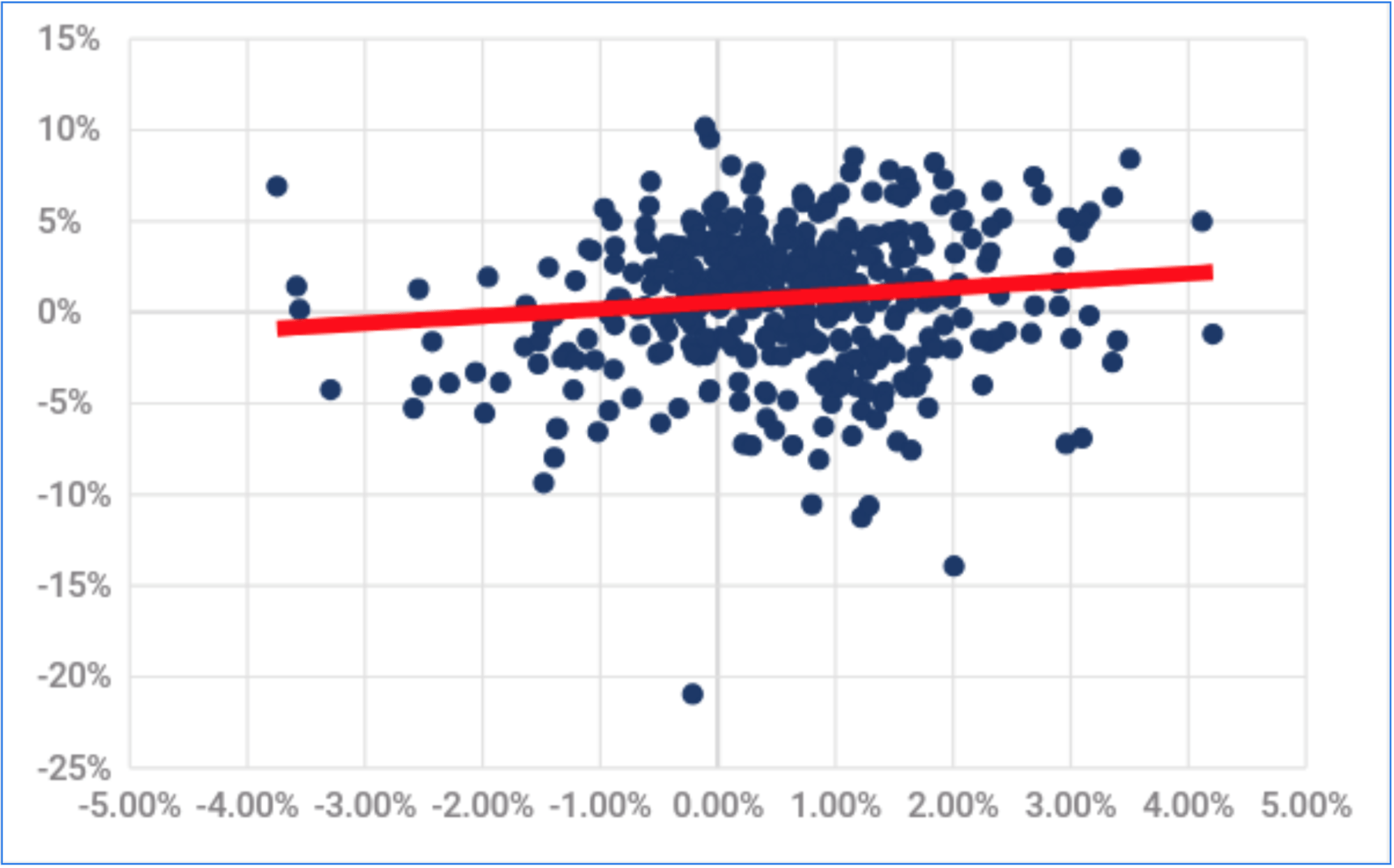

If equities and bonds were negatively correlated, fixed income would never deliver positive returns over the long-term. As shown below (refer Chart 2), the correlation is slightly positive.

Chart 2: Australian equity and bond correlation (post 1989)

Source: Bloomberg, Yarra Capital Management.

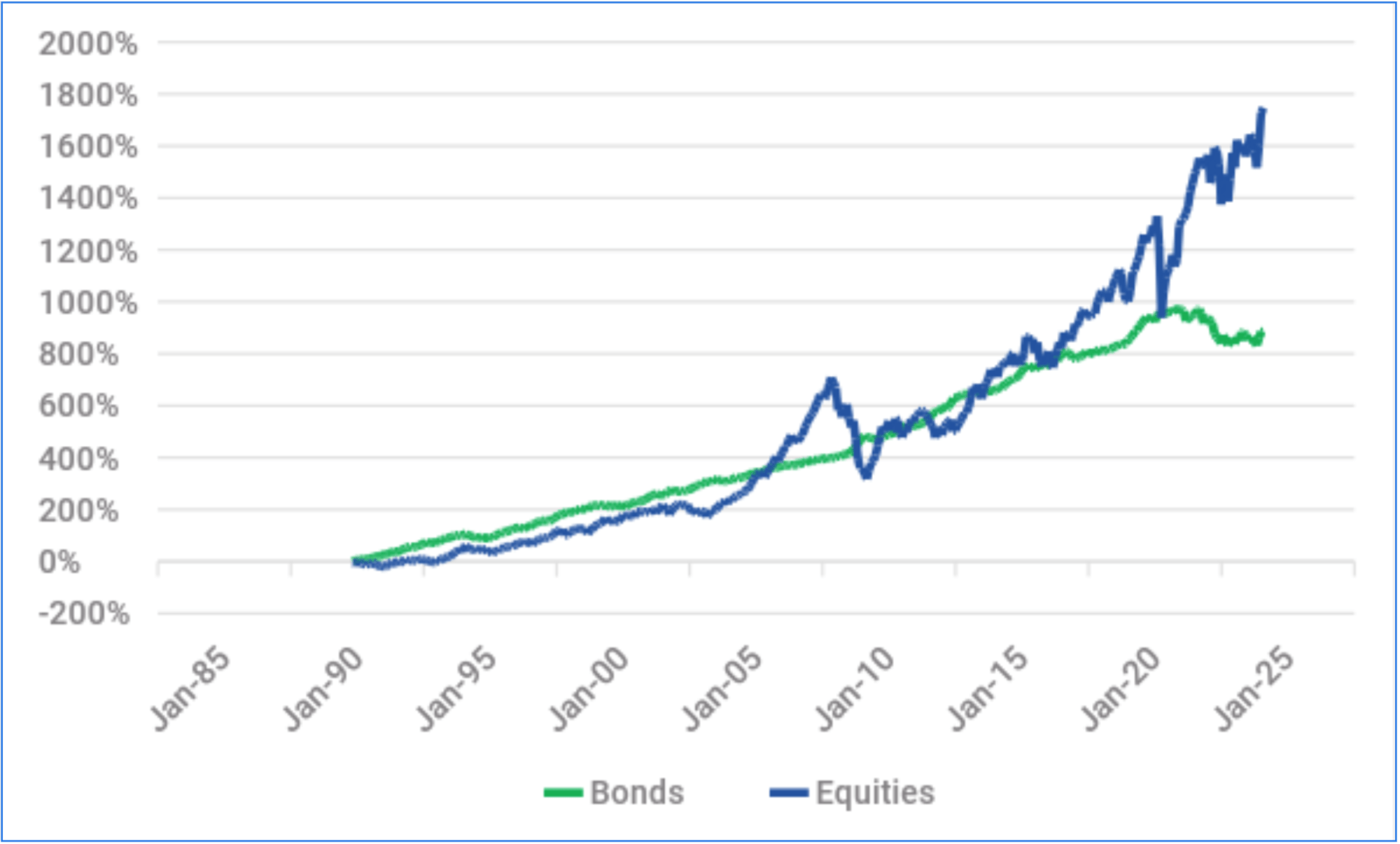

While it’s true that fixed income returns may lag during bull markets, the trade-off can be crucial: in times of market turbulence, fixed income can serve as a critical buffer against sharp declines in equity values, helping to preserve capital and reduce overall portfolio risk (refer Chart 3).

Chart 3: Cumulative bond and equity returns

Source: Bloomberg, Yarra Capital Management

For much of the past 30 years, equity and bond returns have tracked each other. However, over the past decade, equity returns have significantly outstripped bonds by a considerable margin. This period coincides with governments and central banks pumping considerable liquidity into economies.

While the relationship between equities and bonds may still hold, (refer Chart 1), a combination of both asset classes can yield high returns while offering some important protection against equity corrections.

In essence, the role of fixed income extends beyond generating returns; it can provide a vital layer of defence against market volatility. By diversifying portfolios with fixed income, investors may achieve a more balanced risk-return profile, thereby enhancing long-term wealth preservation and stability.

Investing is not just about chasing high returns—it’s about safeguarding against the inevitable storms that come our way. Rather than viewing fixed income solely through the lens of negative correlation, in our view, investors would be wise to remember its true value as a potential dampener of volatility and a of prudent portfolio construction. And in that regard, in our view, fixed income remains an indispensable ally.

Yarra Funds Management Limited (ABN 63 005 885 567, AFSL 230 251) (‘YFM’) is the issuer and responsible entity of a range of registered managed investment schemes, which includes those named in this document (‘Funds’). YFM is not licensed to provide personal financial product advice to retail clients. The information provided contains general financial product advice only. The advice has been prepared without taking into account your personal objectives, financial situation or particular needs. Therefore, before acting on any advice, you should consider the appropriateness of the advice in light of your own or your client’s objectives, financial situation or needs. Prior to investing in any of the Funds, you should obtain and consider the product disclosure statement (‘PDS’) and target market determination (‘TMD’) for the relevant Fund by contacting our Investor Services team on 1800 034 494 or from our website at www.yarracm.com/pdsupdates/. The information set out has been prepared in good faith and while Yarra Funds Management Limited and its related bodies corporate (together, the “Yarra Capital Management Group”) reasonably believe the information and opinions to be current, accurate, or reasonably held at the time of publication, to the maximum extent permitted by law, the Yarra Capital Management Group: (a) makes no warranty as to the content’s accuracy or reliability; and (b) accepts no liability for any direct or indirect loss or damage arising from any errors, omissions, or information that is not up to date. No part of this material may, without the Yarra Capital Management Group’s prior written consent be copied, photocopied, duplicated, adapted, linked to or used to create derivative works in any form by any means.

YFM manages the Fund and will receive fees as set out in the PDS. To the extent that any content set out in this document discusses market activity, macroeconomic views, industry or sector trends, such statements should be construed as general advice only. Any references to specific securities are not intended to be a recommendation to buy, sell, or hold such securities. Past performance is not an indication of, and does not guarantee, future performance. Information about the Fund, including the relevant PDS, should not be construed as an offer to any jurisdiction other than in Australia. With the exception of some Funds that may be offered in New Zealand from time to time (as disclosed in the relevant PDS), we will not accept applications from any person who is not resident in Australia or New Zealand. The Fund is not intended to be sold to any US Persons as defined in Regulation S of the US federal securities laws and has not been registered under the U.S. Securities Act of 1933, as amended.

References to indices, benchmarks or other measures of relative market performance over a specified period of time are provided for your information only and do not imply that the portfolio will achieve similar results. Holdings may change by the time you receive this report. Future portfolio holdings may not be profitable. The information should not be deemed representative of future characteristics for the strategy. There can be no assurance that any targets stated in this document can be achieved. Please be advised that any targets shown are subject to change at any time and are current as of the date of this document only. Targets are objectives and should not be construed as providing any assurance or guarantee as to the results that may be realized in the future from investments in any asset or asset class described herein. If any of the assumptions used do not prove to be true, results may vary substantially. These targets are being shown for informational purposes only.

© Yarra Capital Management, 2024.